Technology combined with eCommerce has taken the world by storm even prior to the Covid-19 crisis. Customer satisfaction, brand recognition, and the effectiveness of the sales procedures are the pillars on which the e-Commerce industry thrives. With technology increasingly infiltrating the e-commerce market, retailers are on the lookout for innovative ways to improve these aspects with newer features to automate processes and stay ahead of the curve.

All this reckoned with, the integration of AI proved to be a game-changer for eCommerce and retail platforms, thus shaping retail digitization.

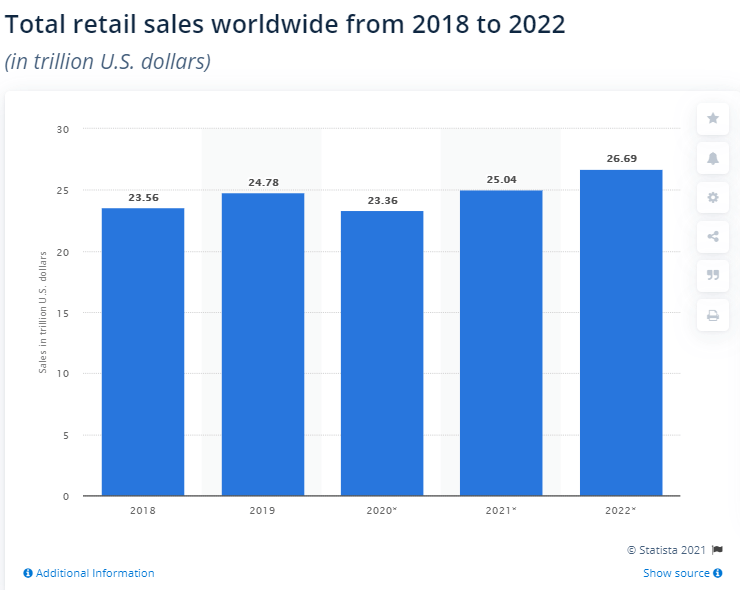

The below graph indicates Statista’s estimates of retail sales to amount to nearly $30 trillion by 2023. Nasdaq estimates 95% of purchases by E-commerce to be facilitated by 2040.

The implementation of Artificial Intelligence in eCommerce can change business functions with demand forecasting and big data based on behavior, product, and, action. The usage of AI in the eCommerce industry brings a set of unique perks to most retailers. Not only does it provide the luxury of shopping but also reduces costs and strengthens the top line and bottom line of the organization.

Recommendation Systems

Ecommerce application development companies offer intuitive web and mobile apps simplifying online ordering for retail customers. They integrate AI that gathers data based on user’s interests that also drive the rate of up-selling. Amazon is the best example that offers a customized web page to millions of users. Amazon’s recommendation engine is well-known for the use of AI in e-commerce to generate suggestions.

Never miss an update from us. Join 10,000+ marketers and leaders.

Another industry magnate, Netflix, saves $1 billion a year, thanks to AI-powered systems that deliver 75% of content to users through targeted and customized recommendations. These technologies are built on top of big data.

Consumers can also receive non-trivial recommendations aligned to their current location. All in all, AI keeps track of your previous shopping habits and makes intelligent suggestions for similar items that you’ll enjoy just as much.

Definitely, the growth of Artificial Intelligence in the eCommerce industry has increased productivity with fully automated data processing to ease lives.

Chatbots in eCommerce

In 2020, nearly 77% of the most successful businesses generated leads through chatbots.

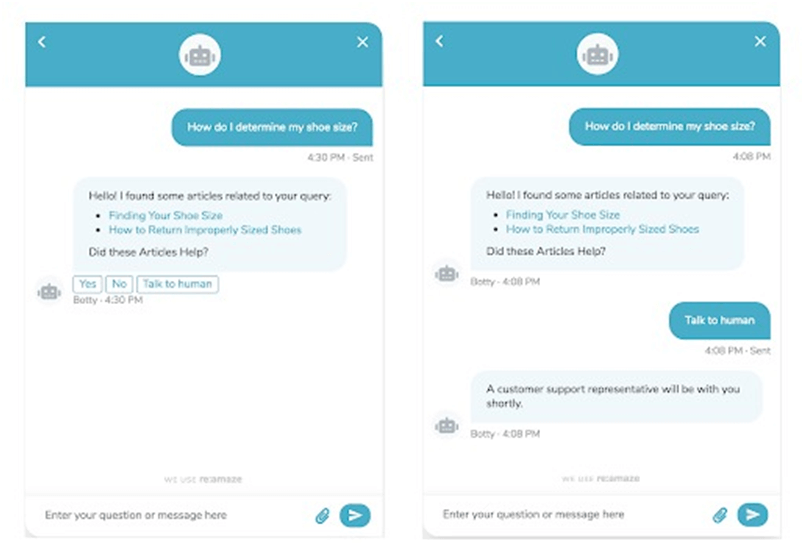

Chatbots are algorithm-based customer service tools built to enhance customer experience.

Chatbots are algorithm-based customer service tools built to enhance customer experience.

According to a study conducted by Bain & Company, businesses that connect and communicate with customers service requests on social media cite a 20% to 40% increase in revenue from those consumers.

Chatbots, which replace human workers, help to make more productive use of the resource by giving them more opportunities to contribute. High user rating and recommendation, increased sales, and user retention spiked the integration of chatbots in the eCommerce space. Reduction in shopping cart abandonment curbed lengthy checkout procedures. This factor was seen as a major reason for success in retaining customers.

For example, Agromall, a Philippines-based eCommerce store sells consumer goods. Their bot makes it easier to extract key information, delivery details, and talk to a support agent.

The bot was designed with two main objectives in mind:

- To streamline the sales process.

- Customers can chat with an agency at any point of the sales process, which will enhance the live chat and service experience.

Argomall’s store bot uses Google’s Site Search API for customers to enter keywords like “Sony TV” and other products.

The results?

After its launch, Agromall generated a whopping 23x increase in ROI, thanks to its chatbots that is the major driving tool for sales and customer service.

Chatbots have made their mark with exponential growth in revenue due to their automated order placement and personalized search results. People who use messaging apps to connect with brands are 53% more likely to shop with a company they can contact.

AR and VR Transforming Ecommerce

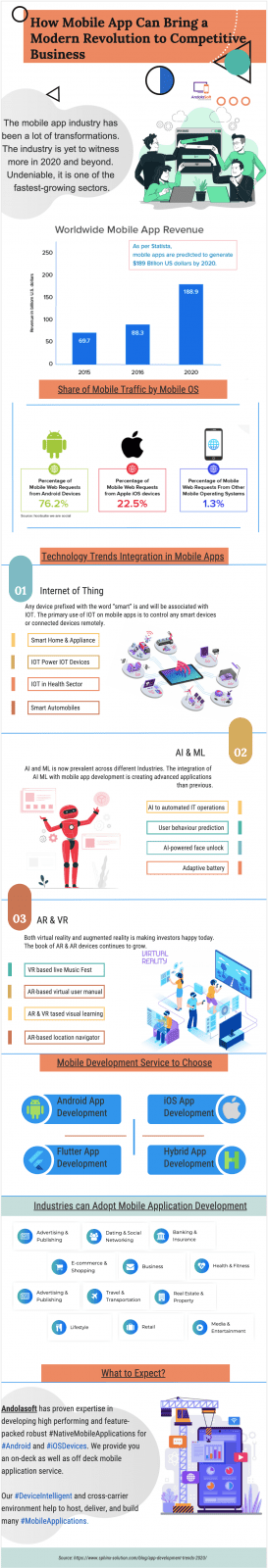

Retailers are aiming to create intuitive and friendly shopping experiences by combining current e-commerce stores with immersive technology like Augmented Reality and Virtual Reality (AR/VR). These innovations have revolutionized the e-commerce industry and altered the way companies operate.

The “try before you buy” phrase has earned its reputation in the eCommerce world. All thanks to the AR & VR Technology that possesses the ability to visualize a product of your choice.

How can the power of AR and VR change the future of shopping?

AR and VR can enable customers to visit interactive showrooms and experience products. Customers get to make informed purchase decisions by simply scanning a product through a Smartphone and viewing a list of products available on numerous eCommerce platforms. It lets you flip through retail stores and flipping through product descriptions and dimensions.

(Source – ecommercegermany.com)

Some of the greatest eCommerce companies are leveraging virtual reality to create incredible experiences and gain a competitive advantage.

Customers are more likely to purchase from brands that use immersive technology to market themselves, according to a recent survey.

On the other hand, retailers can now create virtual versions and take complete control of the exact replica of their physical store. Designing and modifying an online marketplace according to the fluctuating customer trends and product preferences is what the future looks like.

Building an immersive environment capable of simulating real-life is perhaps one of the greatest advantages AR and VR bring to the e-commerce industry.

I’ve worked with the team at Andolasoft on multiple websites. They are professional, responsive, & easy to work with. I’ve had great experiences & would recommend their services to anyone.

Ruthie Miller, Sr. Mktg. Specialist

Salesforce, Houston, Texas

AR and VR can allow consumers to immerse themselves further into the e-commerce experience, enabling the opportunity for rapid growth and increased sales, irrespective of a 360-degree video catalog delivery or simply an interactive digital experience.

AI Integrated Ecommerce App Development

Some of the greatest eCommerce app developments enable custom-made solutions using AI to make the right inquiry to the users. Customer analysis, climatic conditions in a specific location, and historical data from previous records can all be used to forecast sales for eCommerce customers.

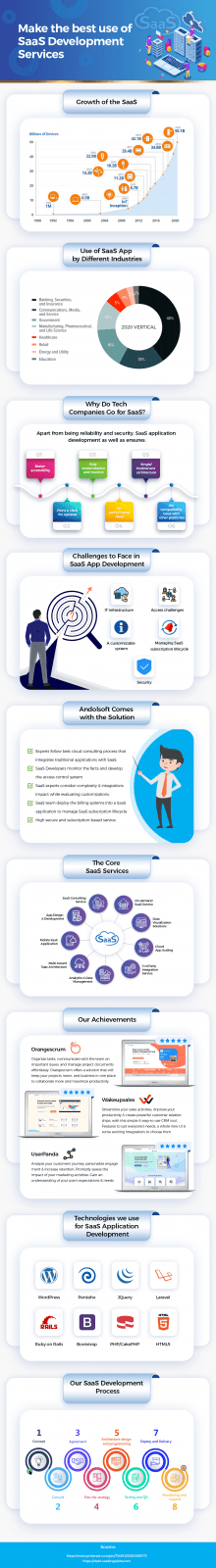

With SaaS in full swing, it’s critical to hire eCommerce developers who can evaluate and automate a large number of customer interactions and processes on a daily basis. The stress on ever-increasing demands of automation challenges in web and mobile app development companies has had a huge impact on online shopping performance. The demand to hire eCommerce developers with a focus on end-to-end solutions increases the stress of offering a significant increment in user fulfillment.

That being said, automated eCommerce development translates into conveying the right message at the right time to the right set of customers.

AI-driven solutions can piece together a variety of insights to automate eCommerce developments for easing the lives of users. Making informed decisions in a matter of seconds is what AI in eCommerce stands for.

Are you looking help on your eCommerce app development! Lets Discuss