The BFSI sector operates in one of the most regulated and risk-sensitive environments in the global economy. Every transaction, customer interaction, and financial exposure is governed by regulatory frameworks that continue to evolve.

At the same time, digital banking, real-time payments, and fintech integrations have significantly increased operational complexity.

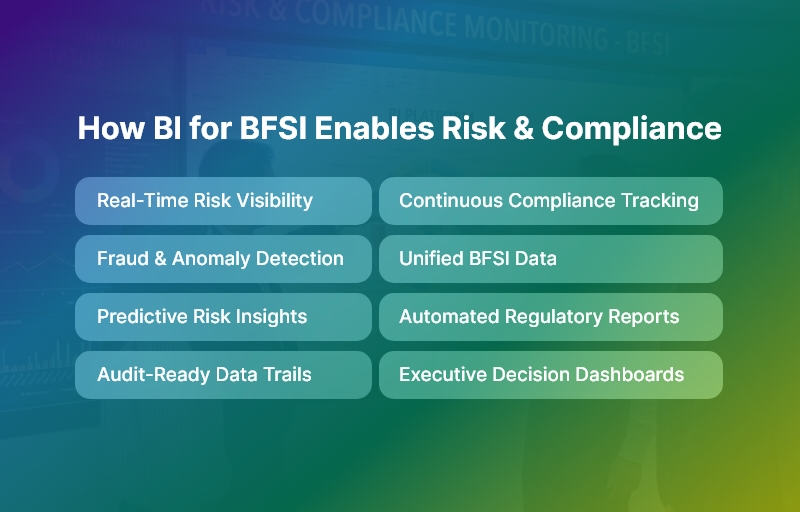

In this environment, BI for BFSI is no longer a reporting enhancement — it is a foundational capability.

Instead of relying on backward-looking reports and manual reconciliations, BFSI organizations are using BI to continuously monitor risk, validate compliance, and enable faster, more confident decision-making.

As a result, leadership teams gain visibility not only into what has happened, but also into what could happen next.

What BI for BFSI Really Means

BI refers to Business Intelligence platforms purpose-built to address the unique risk, compliance, and governance needs of banks, NBFCs, financial services firms, and insurance providers.

Unlike generic BI tools, these platforms are designed around regulatory metrics, risk-weighted analytics, and audit-ready data structures.

More importantly, BI for BFSI unifies data from core banking systems, transaction platforms, risk engines, and operational tools into a single intelligence layer.

This ensures that compliance officers, risk managers, and executives all operate from the same source of truth, eliminating inconsistencies and interpretation gaps.

Why Traditional Reporting Models No Longer Work

Many BFSI institutions still rely on static reports generated from siloed systems. While these reports satisfy basic reporting needs, they fail to support real-time risk and compliance oversight.

By the time issues surface in monthly or quarterly reviews, the damage is often already done.

Traditional reporting struggles because it is reactive, fragmented, and highly manual. Compliance teams spend excessive time compiling data, validating numbers, and responding to audit queries.

BI for BFSI replaces this inefficiency with continuous intelligence, allowing teams to focus on risk mitigation rather than data preparation.

How BI for BFSI Supports Core Risk Monitoring

Credit Risk Management

Credit risk is dynamic by nature. Borrower behavior, economic conditions, and sectoral exposure change constantly.

BI for BFSI enables institutions to track these changes in near real time, providing early warning indicators before risks materialize.

Rather than waiting for defaults or overdue accounts, credit teams can proactively assess portfolio health, stress-test exposure, and rebalance risk.

This shift from reactive to predictive credit management is one of the most valuable outcomes of BI for BFSI adoption.

Market Risk Visibility

Market volatility directly impacts treasury operations, investment portfolios, and trading desks.

Small fluctuations in interest rates or foreign exchange markets can significantly affect profitability and capital adequacy.

With BI for BFSI, institutions gain continuous visibility into market exposure.

Real-time dashboards allow leadership to understand sensitivity, simulate adverse scenarios, and align risk appetite with actual market conditions.

Consequently, decisions become data-driven rather than assumption-based.

Operational Risk Control

Operational risk often emerges quietly — through process inefficiencies, system outages, or control failures. These risks are difficult to manage without integrated visibility across departments and branches.

BI for BFSI consolidates operational data, making it easier to identify recurring incidents, process bottlenecks, and control weaknesses.

Over time, organizations can correlate operational risk events with financial impact, enabling targeted improvements and stronger internal controls.

Fraud Risk Detection

Fraud risk has intensified with digital channels and real-time transactions. Manual review processes are no longer sufficient to detect sophisticated fraud patterns.

BI for BFSI enhances fraud monitoring by analyzing transaction behavior, identifying anomalies, and triggering alerts based on predefined risk thresholds.

This intelligence-led approach allows fraud teams to act faster, reduce losses, and improve customer trust.

Strengthening Compliance Through BI for BFSI

Compliance is no longer a periodic exercise. Regulators expect continuous oversight, transparency, and traceability.

BI enables this shift by embedding compliance monitoring directly into operational workflows.

Instead of checking compliance after the fact, institutions can continuously track regulatory thresholds, monitor policy adherence, and flag exceptions before violations occur.

This proactive approach significantly reduces regulatory risk and improves supervisory confidence.

Automated Regulatory Reporting and Audit Readiness

Regulatory reporting demands precision, consistency, and defensible data lineage. Manual reporting processes increase the risk of errors and audit findings.

With BI for BFSI, regulatory reports are generated directly from validated source data. Every metric is time-stamped, traceable, and version-controlled.

As a result, audit readiness becomes an outcome of daily operations rather than a last-minute effort.

Key Capabilities Required in BI for BFSI Platforms

To deliver real value, BI for BFSI platforms must include:

- Unified data integration across core banking, ERP, CRM, and risk systems

- Role-based dashboards for compliance, risk, and executive teams

- Drill-down analytics for investigation and root-cause analysis

- Predictive insights for emerging risk trends

These capabilities ensure BI supports governance and decision-making, not just visualization.

Best Practices for Implementing BI for BFSI

Successful BI initiatives begin with regulatory and risk priorities rather than dashboard design.

Organizations should standardize data definitions early, design role-specific KPIs, and automate alerts instead of relying solely on reports.

Most importantly, BI should be treated as a governance and control platform.

When aligned with compliance objectives, BI for BFSI becomes a long-term strategic asset rather than a short-term analytics project.

The Future of BI for BFSI

Looking ahead, BI for BFSI will increasingly incorporate AI-driven risk prediction, automated regulatory intelligence, and ESG risk monitoring.

As regulations become more complex and data volumes continue to grow, institutions with advanced BI capabilities will be better positioned to adapt, comply, and scale securely.

Final Thoughts: BI for BFSI as a Strategic Imperative

In today’s BFSI landscape, risk monitoring and compliance define institutional resilience.

Organizations that depend on fragmented reporting remain exposed to regulatory and operational shocks.

Those that adopt BI gain continuous visibility, predictive insight, and audit-ready governance.

By transforming data into intelligence, BI for BFSI enables banks and financial institutions to move faster, comply smarter, and operate with confidence in an increasingly regulated world.